Democrats in Washington, D.C., are misrepresenting major criticisms of President Trump’s ‘big beautiful bill’ with incorrect facts, according to an expert who spoke to Fox News Digital this week as Trump’s budget reconciliation package is debated in Congress.

‘The bill doesn’t cut benefits for anyone who has income below the poverty line, anyone who is working at least 20 hours a week and not caring for a child, and people who are Americans,’ Jim Agresti, president and cofounder of Just Facts, told Fox News Digital in response to criticisms from Democrats and a handful of Republicans, including Sen. Josh Hawley, that Trump’s bill will cut Medicaid and disproportionately hurt the poor.

‘In other words, it cuts out illegal immigrants who are not Americans and fraudsters. So that narrative has no basis in reality. See, what’s been going on since the Medicaid program was started? Is that it’s been expanded and expanded and extended. You know, it got its start in 1966. And since that time, the poverty rate has stayed roughly level around 11% to 15%. While the portion of people in the United States on Medicaid has skyrocketed from 3% to 29%. Right now, 2.5 times more people are on Medicaid than are in poverty.’

Medicaid cuts and reform have been a major sticking point with Democrats, who have merged data from two new reports from the nonpartisan Congressional Budget Office (CBO) to back up claims that nearly 14 million would lose coverage. The White House and Republicans have objected, as not all the policy proposals evaluated were actually included in Republicans’ legislation, and far fewer people would actually face insurance loss.

Instead, Republicans argue that their proposed reforms to implement work requirements, strengthen eligibility checks and crack down on Medicaid for illegal immigrants preserve the program for those who really need it.

‘I agree,’ Dem. Rep. Jasmine Crockett said in response to a claim on CNN that Republicans ‘want poor people to die’ with Medicaid cuts.

Agresti told Fox News Digital that the Medicaid cuts are aimed at bringing people out of poverty and waste.

‘It’s putting some criteria down to say, ‘Hey, if you want this, and you’re not in poverty, you need to work,” Agresti said. ‘You need to do something to better your situation, which is what these programs are supposed to be, lifting people out of poverty, not sticking them there for eternity. So the whole idea is to get people working, give them an incentive. Hey, if you want to do better in life, and you want this Medicaid coverage, then you have to earn it.’

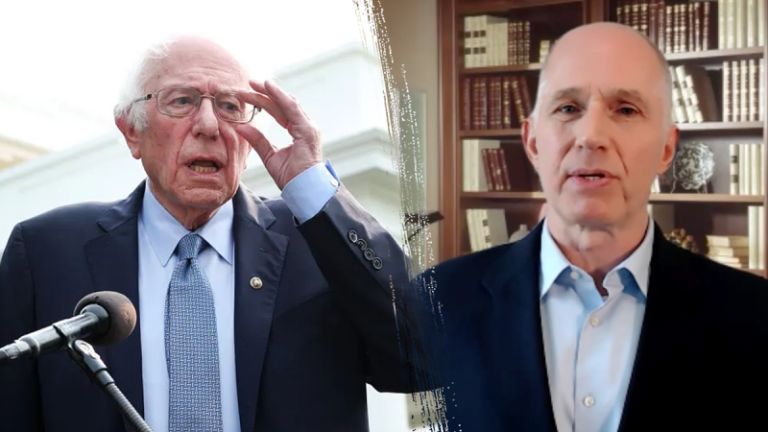

Independent Sen. Bernie Sanders has claimed the bill is a ‘death sentence for the working class,’ because it raises health insurance ‘copayments for poor people.’

Agresti called that claim ‘outlandish.’

‘First of all, the Big Beautiful Bill does not raise copayments on anyone who’s below the poverty line,’ he explained. ‘Now, for people who are above the poverty line, it requires states to at least charge some sort of copayment, and it also reduces, actually, the max copayment from $100 per visit to $35 per visit.’

Agresti went on to explain that under the current system, ‘people have basically free rein to just go to a doctor or an emergency room or any other place without any co-payment, and they’re not in poverty.’

‘What ends up happening is they waste a ton of money,’ Agresti said. ‘This has been proven through randomized control trials, which are the gold standard for social science analysis, where you have people in a lottery system, some people get the benefit, and some people don’t, and what you end up seeing is that people who don’t have to have skin in the game, abuse emergency rooms, they go there for a stuffy nose, rack up all this money, and it does nothing to improve their health. It’s just wasteful.’

In a statement to Fox News Digital, Sanders Communications Director Anna Bahr said, ‘Mr. Agresti’s facts here are simply incorrect.’

Sanders’ office added that ‘nearly half of all enrollees on the ACA exchanges are Republicans’ and pointed to the House-passed reconciliation bill that Sanders’ office argues ‘says that if a worker can’t navigate the maze of paperwork that the bill creates for Medicaid enrollees, they are barred from receiving ACA tax credits as well.’

‘But workers must earn at least $15,650 per year to qualify for tax credits on the ACA marketplaces – approximately equal to the annual income for a full-time worker earning the federal minimum wage.’

Sanders’ office also pointed to ‘CBO estimates that 16 million people will lose insurance as a result of the House-passed bill and the Republicans ending the ACA’s enhanced premium tax credits.’

Sanders’ office also reiterated that the House-passed bill makes a ‘fundamental change’ to copay for Medicaid beneficiaries, shifting from optional to mandatory.

‘While claiming that I’m ‘incorrect,’ Sanders’ staff fails to provide a single fact that shows the BBB cuts health care for poor working Americans,’ Agresti responded.

‘It’s especially laughable that they cite expanded Obamacare subsidies in this context, because people in poverty aren’t even eligible for them,’ Agresti continued. ‘After this ‘temporary’ Covid-era handout expires, people with incomes up to 400% of the federal poverty level — or $150,600 for a family of five — will still be eligible for this welfare program, although they will receive less.’

Agresti argued that the claim a ‘max $35 copay (for people who are not poor) ‘hurts working families’’ is not supported by research ‘which makes generalizations and merely cites ‘associations.”

‘As commonly taught in high school math, association doesn’t prove causation,’ Agresti said.

Sanders’ office told Fox News Digital, ‘Mr. Agresti seems to believe that a working family of four earning only $32,150 per year doesn’t deserve help affording their health care. Health care in the United States is more expensive than anywhere in the world. Terminating health care coverage for 16 million Americans and increasing health care costs for millions will make it harder for working people to afford the health care they need, even if Mr. Agresti doesn’t agree.’

Agresti also took issue with the narrative that cuts cannot be made to Medicaid without cutting benefits to people who are entitled to them.

‘The Government Accountability Office has put out figures that are astonishing, hundreds of billions of dollars a year are going to waste,’ Agresti said. ‘So, yeah, some criteria to make sure that doesn’t happen is a wise idea. Unfortunately, there is a ton of white-collar crime in this country, and this kind of crime is a white-collar crime. It’s not committed with a gun, or by robbing or punching someone, it’s committed by fraud, and there’s an enormous amount of it.

‘And the big, beautiful bill, again, seeks to rein that in by putting a criteria to make sure we’re checking people’s income, we’re checking their assets. A lot of these federal programs, government health care programs, they’ve stopped checking assets. So you could be a lottery winner sitting on $3 million in cash and have very little income. And still get children’s health insurance program benefits for your kids.’

Hawley said on Monday that he did not have a problem with some of the marquee changes to Medicaid that his House Republican counterparts wanted, including stricter work requirements, booting illegal immigrants from benefit rolls and rooting out waste, fraud and abuse in the program that serves tens of millions of Americans.

However, he noted that about 1.3 million Missourians rely on Medicaid and the Children’s Health Insurance Program (CHIP), and contended that most were working.

‘These are not people who are sitting around, these are people who are working,’ he said. ‘They’re on Medicaid because they cannot afford private health insurance, and they don’t get it on the job.’

‘And I just think it’s wrong to go to those people and say, ‘Well, you know, we know you’re doing the best, we know that you’re working hard, but we’re going to take away your health care access,’’ he continued.

Fox News Digital’s Diana Stancy and Alex Miller contributed to this report.

This post appeared first on FOX NEWS